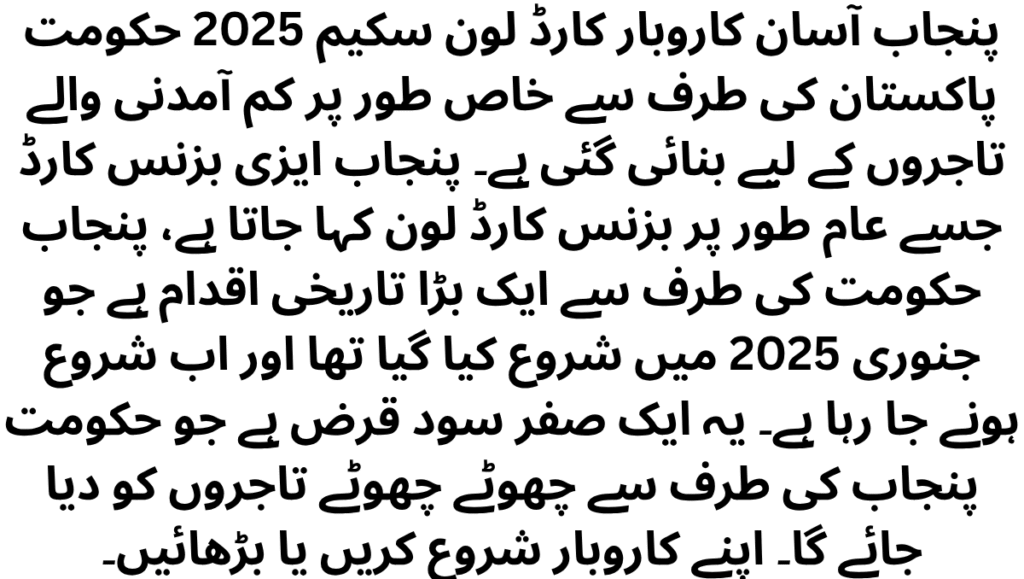

Punjab Asaan Karobar Card loan scheme 2025 is specially designed by government of Pakistan for low income businessmen.Punjab Easy Business Card, commonly known as Business Card Loan, is a major historic initiative by the Punjab government which was launched in January 2025 and is now going to be launched.This is a zero-interest loan from the Government of Pakistan that will be given to small and medium entrepreneurs across Punjab to help them start or expand their businesses.

Also Read : Punjab Free Solar Panel Scheme 2025 – Complete Guide to Eligibility, Application & Updates

Table of Contents

🧩 What Is the Punjab Asaan Karobar Card?

💳 The Business Card is a modern SMS card that allows its users:

💰 In this program, you get 1 million rupees without any interest.

📅 You will remain funded for 12 months in this program.

🧾 The total amount of payment in this program can be made up to 36 months.

🏢 This program is designed for business use and includes vendor payments, utilities, government fees, taxes, and up to 25% cash back.

Also Read : Punjab Free Solar Panel Scheme 2025: Eligibility, Application & Latest Updates

📌 Eligibility Criteria of Punjab Asaan Karobar Card

📝 To apply for this scheme, you must have:

🎂 To apply for this scheme, you must be between 21 and 57 years of age.

🆔 The applicant must have a valid CNIC card and mobile number and be a resident of the Pakistani province of Punjab.

🏪 The applicant must be a small business owner or intend to be one in Punjab.

💳 The applicant’s credit must be free from any debt.

💵 The applicant will pay a non-refundable PKR 500 as a processing fee.

👥 The applicant will have to provide two unbiased references for verification.

🛠️ Required Documents for Punjab Asaan Karobar Card

🖼️ Applicants must have a photo and CNIC card.

🏠 Applicants must have proof of residency.

📄 Applicants must have business documents.

🏦 Applicants must have bank statements and proof of income.

👥 Applicants must have two references.

📊 Applicants must have proof of tax compliance.

Also Read : Punjab Green Tractor Scheme Phase 2 – Latest Updates, Eligibility & How to Apply Positively (2025)

💰 Financial Features & Charges

💸 In this Punjab Asaan Karobar Card, the loan amount is 100k PKR – 1 million PKR.

📆 This scheme provides 3 years of loan repayment assistance, including EMI and interest.

💳 In this scheme, the annual fee of the loan card will be deducted at PKR25,000 + FED.

🧾 A processing fee of Rs 500 will be charged for taking a loan under this scheme.

⚠️ In this scheme, the penalty for late payment of the loan will be as per the bank’s policy.

🛡️ This scheme will also provide life insurance coverage.

🛡️ Security & Compliance

Digital personal guarantee is required for this scheme.

This scheme also includes life insurance.

This scheme requires physical verification within 6 months and a full year later.

Verification of FBA/PRA should be mandatory after 6 months of taking this scheme.

Also Read : Afghan Refugee Return Deadline 2025 – Latest Government Notice & Updates

✍️ Conclusion

The Easy Business Card is not just for capital, it is for empowerment.This program is simple, comes with zero interest and a solid plan.This has been started for low-income and medium-income entrepreneurs, which will bring happiness and eliminate poverty in the country.This is the time to apply and participate in this scheme and use it to grow and develop your business.

❓ What is the Punjab Asaan Karobar Card?

The Punjab Asaan Karobar Card is a government-backed financial assistance program launched by the Government of Punjab to support small and medium-sized business owners. It provides interest-free loans ranging from PKR 100,000 to PKR 1,000,000 with easy repayment plans, EMI assistance, and insurance coverage, helping entrepreneurs grow and sustain their businesses.

❓ Who is eligible to apply for the Punjab Asaan Karobar Card?

To be eligible for this scheme, applicants must:

Be residents of Punjab.

Be between 21 and 57 years of age.

Possess a valid CNIC and mobile number.

Be either existing small business owners or individuals intending to start a business in Punjab.

Have no outstanding debts or bad credit history.

Submit two unbiased references.

Provide proof of tax compliance, bank statements, and business documents.

❓ What documents are required to apply for the scheme?

Applicants must provide the following documents:

Recent passport-size photo

Valid CNIC card

Proof of residency (utility bill, rent agreement, etc.)

Business-related documents (business license, registration, etc.)

Bank statements from the past 6 months

Proof of income

Tax compliance certificate (FBR registration, NTN)

Two references for verification

❓ How can I apply for the Punjab Asaan Karobar Card?

To apply for the scheme, follow these steps:

Visit the official government portal or the designated bank’s branch.

Fill out the online application form or get a physical form from the bank.

Attach all the required documents.

Submit the form and pay the PKR 500 processing fee.

Wait for verification and approval.

Upon approval, collect your Punjab Asaan Karobar Card and begin using the facility.

❓ What types of expenses are allowed under this scheme?

The loan amount can be used for:

Vendor payments

Utility bills

Government fees and taxes

Equipment purchases

Inventory or stock

Business expansion

And up to 25% cash back on eligible business transactions.